In its basic form, a Letter of Credit (or LC) is a document produced by a financial institution delivered to another financial institution that guarantees an Importer’s payment to an Exporter will be received on time and for the correct amount. The Importer is required to send payment to the issuing institution who then transfers funds to the Exporter’s advising institution or directly to the Exporter. In the end, the Exporter will receive payment as long as the transportation of the goods is compliant with the LC’s terms and conditions. Letters of Credit are most often used between Banks that are in different countries for international trade.

Letters of Credit Process

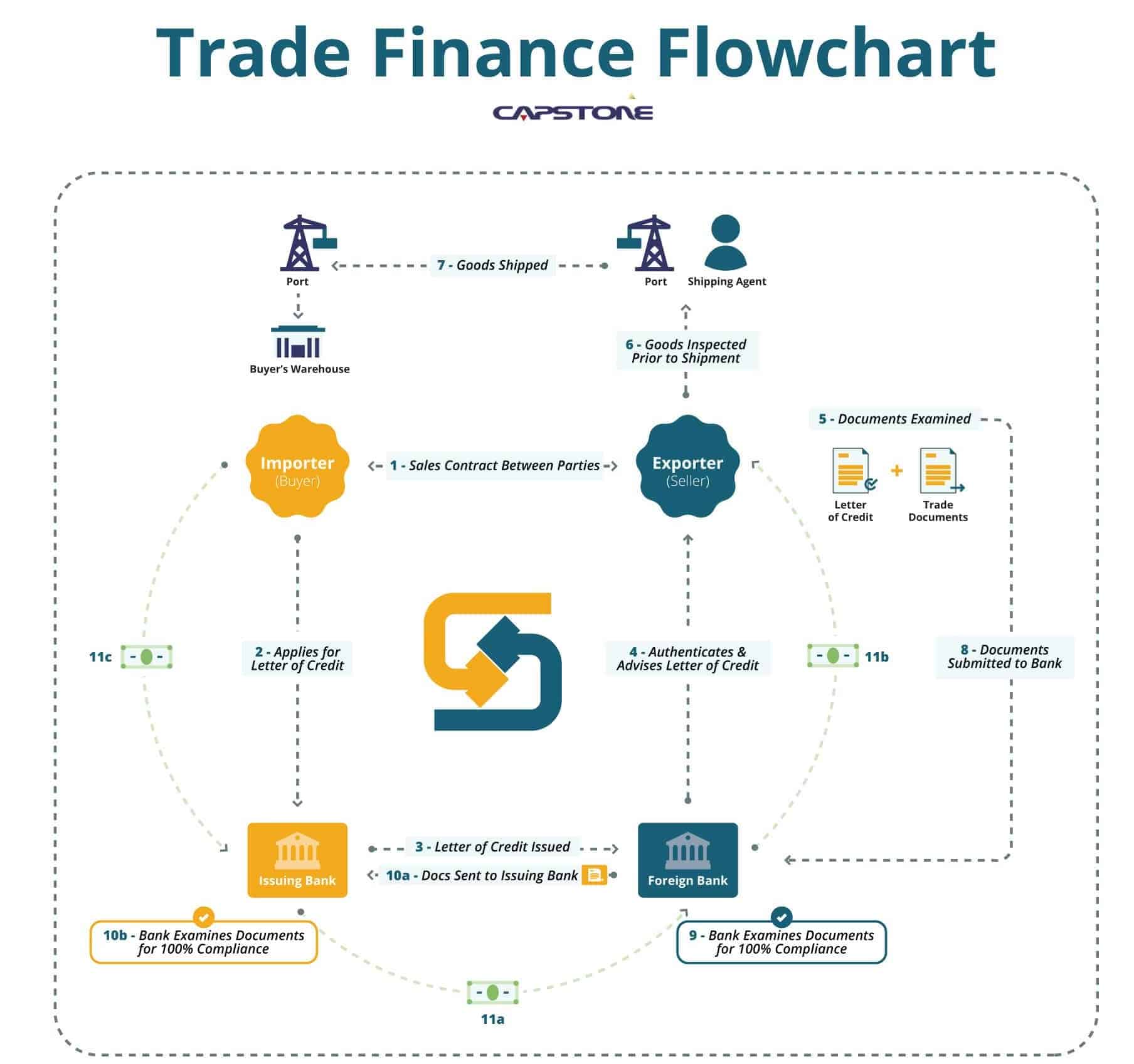

- Importer and Exporter enter into a Sale Contract.

- Importer applies for the Letter of Credit with their Bank.

- The Bank issues the LC and sends it to the Exporter’s (Foreign) Bank.

- Foreign Bank authenticates & advises the LC.

- Exporter receives LC and produces Trade Documents. Once the LC matches the Terms and Conditions of the Sales Contract, the goods are manufactured.

- Prior to shipment, the goods are inspected.

- Goods are shipped to the Importer.

- Exporter submits Trade Documents to their Bank.

- Foreign Bank examines the Trade Documents for compliance.

- Foreign Bank sends Trade Documents to Issuing Bank who also examines Trade Document for compliance.

- If all Terms and Conditions have been met, payment will be disbursed among the parties involved.

Trade Finance

Trade Finance assists with trade cycle funding gaps and allows businesses to obtain goods from a Supplier with cash upfront. When a Supplier abroad is exporting goods to a business partner elsewhere, they will want assurance that payment will be received in a timely fashion. Instead of the business owner paying for goods right away, the institution handling their import financing will instead produce a Letter of Credit that will be presented to the Supplier or their finance company. As previously mentioned, the Letter of Credit serves as a guarantee of payment when the conditions of the initial Supplier agreement are met. Upon receipt of goods, payment is made to the Supplier or their finance company.

This arrangement can be used for a one-time purchase of supplies or continuingly if there will be a lasting business relationship between the Importer and the Exporter.

Reasons to Use an LC with Trade Finance

There are a few key reasons why an LC should be used with Trade Finance.

- First, International Trade between countries is difficult due to a variety of issues including differing laws, customs, languages, currencies, and so forth.

- In general, LCs offer a more secure method of payment for both parties involved.

- Next, the financial institutions handling the transaction offer their expertise and resources for aiding the completion of the transaction.

- The central benefit of using an LC is that it mitigates the risk of the buyer missing their payments, especially if the Seller is unsure of the buyer’s credit.

Need funding for trade? Capstone is here to help: Let us work with you today to help you find the best solution to your cash needs without taking on more debt. Whether you are facing an immediate one-time need for cash to secure a contract, or you require a long-term solution to cash flow, contact our skilled team of representatives today and let us work with you to find the best options for your funding needs.