Avoid These Four Mistakes When Choosing A Factoring Company

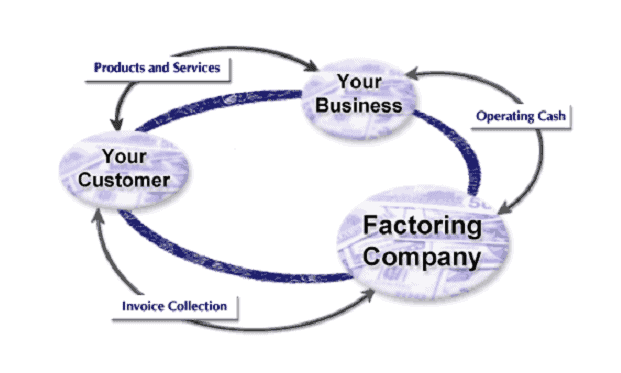

Factoring is one of the financing methods you can use to get the working capital to grow your business. However, like any other type of financing, it is important that you avoid some of the common errors made when you are selecting the company you...