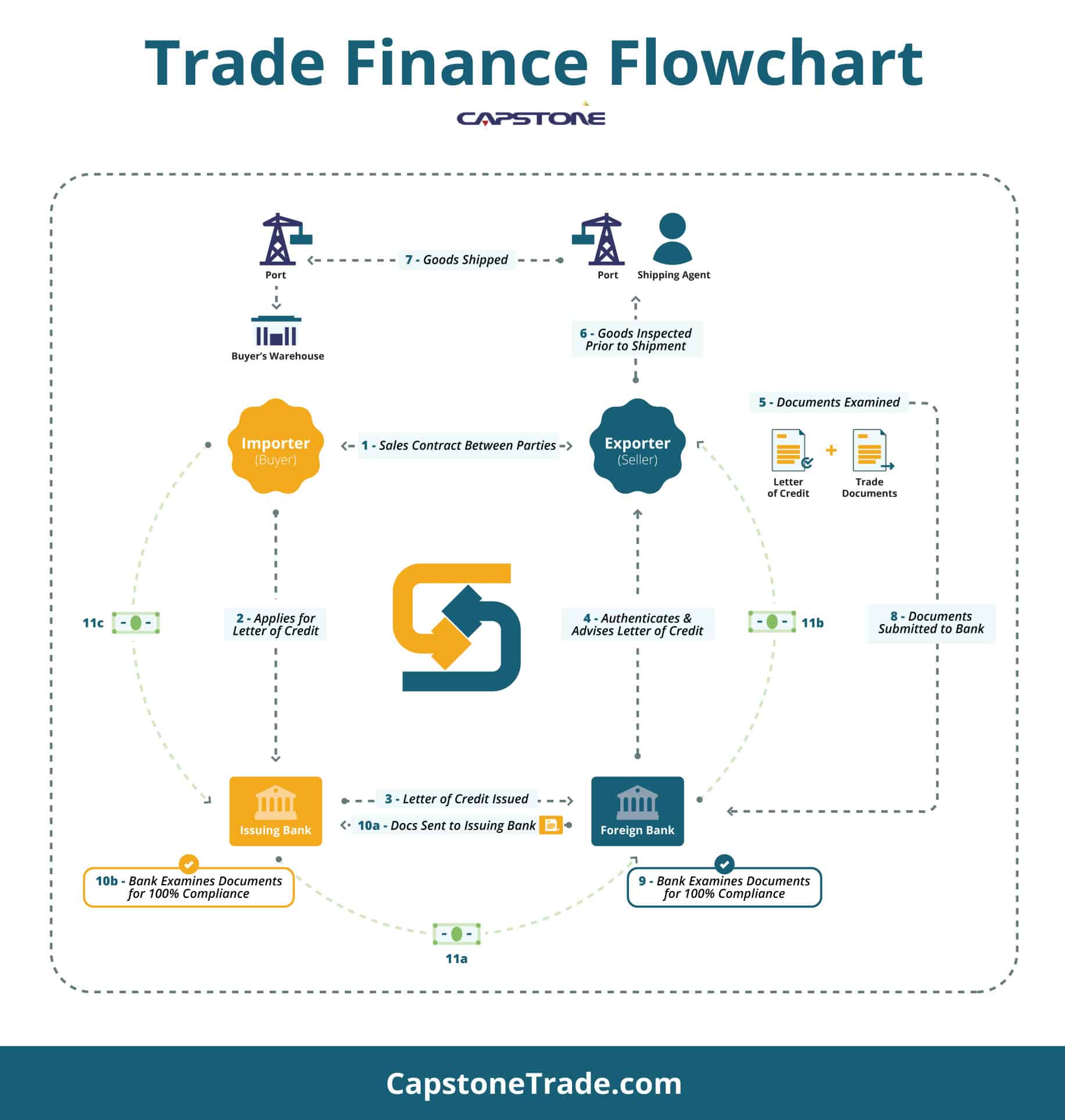

TRADE FINANCING SOLUTIONS

When running a business, you must be strategic when choosing who your business partners are and who you’ll trust as your suppliers. Sometimes, the most cost-effective option is from suppliers abroad. Capstone’s Trade Financing and Import Financing program provide businesses with access to flexible financing and logistics solutions through Capstone’s network of buyers, wholesalers, and distributors. This allows for a seamless transaction between the business and the overseas supplier that does not interrupt cash flow. It also grants security and peace of mind to both the business, who may be uneasy with the risk associated with purchasing abroad and the supplier, who may be wary about shipping large amounts of goods without payment.